Reporting to The Swedish Tax Agency

All employers must declare salary payments, tax deductions and benefits for both their current and former employees to The Swedish Tax Agency (Skatteverket). Employers do this by submitting the Individual Employer Declaration (Arbetsgivardeklaration på individnivå, AGI). Your employer receives some of the data for your AGI from Alecta.

Annual income statement

If you are employed or have had a previous employer whose occupational pension is administered and paid out by Alecta, you can see what information your employer has provided to the Swedish Tax Agency in the ‘Annual income statement’ (årliga kontrolluppgiften).

We send you your annual income statement along with your annual pension statement in January every year. You will then find your income statement in ‘My Pages’ under ‘Messages’ (Meddelanden).

PAYE tax return

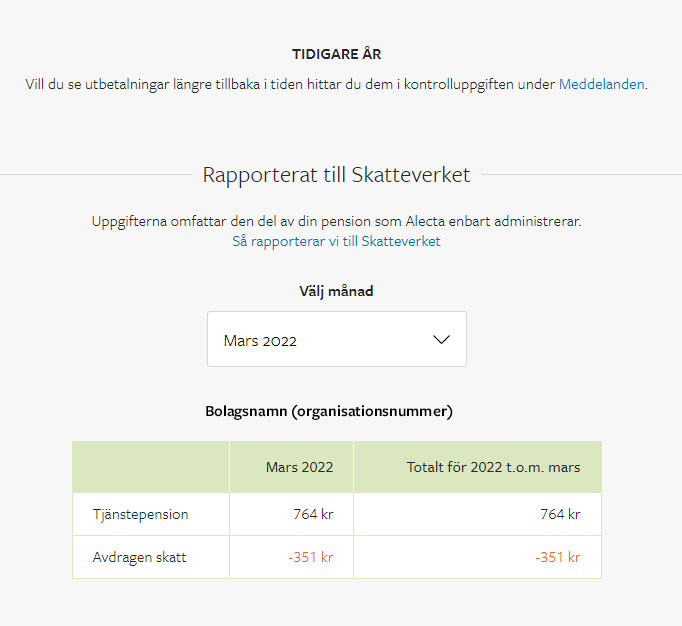

If you have worked for an employer who only allows Alecta to manage and pay out your pension on behalf of this former employer, you can see what information your employer provides to the Swedish Tax Agency in ‘My Pages’ under ‘Payment’ (Utbetalningar).

From 2023, you can find this information on Alecta’s website under ‘Payment’ (Utbetalning) and ‘Reported to the Swedish Tax Agency’ (Rapporterat till Skatteverket).

Frequently asked questions

How can I check what information has already been submitted to the Swedish Tax Agency?

You can see all the reported data by logging in to ‘My Pages’ on the Swedish Tax Agency’s website.

Why do I get an Annual income statement and a monthly PAYE tax return?

If you receive both an Annual income statement and a monthly PAYE tax return, your pension payment is divided into two parts. Alecta administers and pays out one part, and your former employer has chosen a different way of administering the other part, with Alecta only managing the payment.

Under new legislation introduced in 2019, the tax on the part of your payment that we administer on behalf of your former employer must now be reported on a monthly basis and in your former employer's name. This is why you receive a separate monthly PAYE tax return.

How can I find this in ‘My Pages’ on alecta.se?

You can see your monthly PAYE tax return in ‘My Pages’ under the ‘Payment’ (Utbetalning) tab after scrolling down to ‘Reported to the Swedish Tax Agency’ (Rapporterat till Skatteverket).

Will there be changes to the Annual income statement too?

Your income statement will be divided into two parts. One part consists of the Annual income statement and the other part consists of the monthly PAYE tax returns. This section summarises all the monthly PAYE tax returns we have reported to the Swedish Tax Agency during the year.