Frequently asked questions

How will my pension be affected by Alecta’s investments in American banks?

Customers with an ITP 2 defined benefit pension (applies to those born in 1978 or earlier):

Your pension is not affected in any way. The value of your pension is determined by your salary level and the number of years in which you work, not by Alecta's returns. If your ITP 2 is currently being paid out, this will not affect you either – your pension will be paid at the same rate as before.

Customers with an ITP1 or ITPK defined contribution pension:

Your pension will be paid at the same rate as now for the remainder of the year. While returns are a factor when calculating your new pension amount at the end of the year, the US bank turmoil will only marginally affect your pension. The losses in the three banks concerned represent less than 2% of the total pension capital managed by Alecta. Over 98% of Alecta's investment portfolio is intact and continues to generate returns.

How does this affect employers?

In 2023, Alecta will reduce employers' costs for defined benefit retirement pensions and family pensions by up to 40 per cent through premium reductions. In addition, risk premiums will be reduced by up to 90%. This is because Alecta's assets exceed the present value of expected future payments by a wide margin. The turmoil in the US banking system does not affect premium reductions in 2023, and the prospect of continued premium reductions in the future looks good. As of 31 March, the collective consolidation level was 170%, well above the 150% limit at which employers receive premium reductions.

How good are Alecta's returns compared to its competitors?

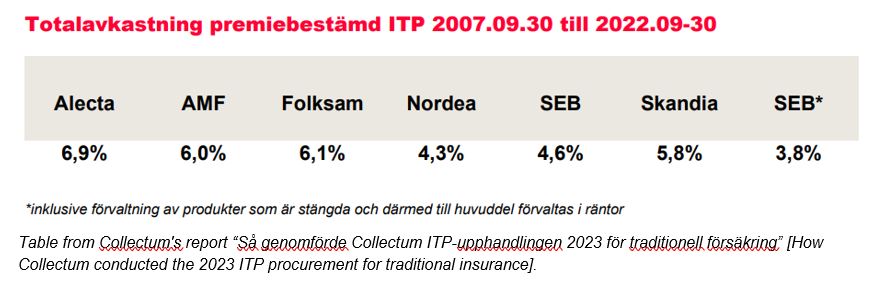

Alecta has delivered the best return over the past 5, 10 and 15 years out of all the companies offering traditional insurance within ITP occupational pensions. This was recently confirmed when the results of the large ITP procurement were announced. As part of the procurement process, Alecta was evaluated against other banks and pension companies in Sweden. The study, which is very comprehensive, looks at both historical performance and the estimated ability to deliver good pensions in the future.

As a result of the procurement process, Alecta has been selected as one of the five eligible options in traditional insurance and will also remain the default option for the period 2023–2028. Collectum, the organisation that procures the companies that employees can choose to manage their ITP pension, writes: “Historically, Alecta has the highest total return. Whether you look back 5, 10 or 15 years, Alecta has the best total return. Alecta's product is also predicted to provide the highest pension payout at the lowest cost. Overall, Alecta was the best in the evaluation we conducted.”

Table from Collectum's report “Så genomförde Collectum ITP-upphandlingen 2023 för traditionell försäkring” [How Collectum conducted the 2023 ITP procurement for traditional insurance].

Even when the losses from the US banks are included, Alecta remains ahead of its competitors. You can track Alecta's performance for defined contribution pensions (in Swedish) here.

A description in Swedish of Collectum's process for evaluating traditional insurance administrators can be found here.

Why does Alecta invest pension money in the stock market in the first place? Isn't that risky?

Taking care of our customers' money is extremely important to us. However, if we didn't generate returns on the money, and just held on to the employers' contributions, pensions would only be about a quarter of the size of the pensions we pay out today.

Creating returns by investing your money in assets that grow throughout the time in which they are invested is therefore very important. One way for Alecta to generate returns is to invest in shares. This means that customers benefit from the companies' profits and increase in value. Over time, our customers’ pensions grow substantially. Alecta invests a large proportion of its capital in Swedish companies and businesses, but we also look for investment opportunities that we strongly believe in in Europe and the US. In addition to shares, we also invest in government bonds, corporate bonds, real estate and non-listed companies.

For over 100 years, Alecta has been trusted by our customers to manage their money. We do not take this responsibility lightly. Over the years, we have navigated through pandemics, two world wars, interest rate turmoil, the dot-com crash, the financial crisis and numerous other challenging events – and always delivered secure pensions. We will continue to do so.

What is Alecta doing now to restore customer confidence?

Restoring our customers' confidence is something we are currently focusing on. One way we are doing this is by being as available as possible to both our customers and the media. In recent weeks, we have had hundreds of contacts with journalists and conducted a large number of interviews to explain what happened, if/how it affects our customers and what measures we are now taking. We are in touch with our customers through individual calls and emails to our customer service team and through regular information updates on alecta.se.

Alecta's Board has decided that new leadership is needed to implement the necessary changes in asset management and restore confidence in Alecta. As a result, CEO Magnus Billing is being replaced by a new acting CEO – Alecta's former Deputy CEO Katarina Thorslund. The process of finding a new permanent CEO will begin immediately. Alecta's Chair of the Board, Ingrid Bonde, will in the meantime support the organisation in her role as Chair. Ann Grevelius is appointed Acting Head of Equities and Kerim Kaskal is appointed Acting Head of Asset Management.

In addition, the Alecta Board has decided to investigate the situation that has arisen. The investigation, which will be completed before the summer, will focus on whether there is reason to make changes to the current investment strategy, risk allocation and asset management mandate. The Management Team will use external resources for this investigation. The conclusions of this work will be made public.

Read more about the changes in our press release (in Swedish):

Alecta vidtar åtgärder till följd av förluster i tre amerikanska banker

Magnus Billing lämnar VD-posten

How much involvement did Alecta have in the US banks?

From 2016, Alecta invested money in the American banks Silicon Valley Bank and Signature Bank, which have now been taken over by the Federal Deposit Insurance Corporation (FDIC). Alecta also invested SEK 9.7 billion in First Republic Bank, a bank with a completely different business model but which started to lose a lot of share value due to the financial market turmoil in March. Alecta then sold its entire holding in the bank.

How could this happen?

Alecta manages capital totalling over SEK 1100 billion. For it to increase, we need to invest the capital in shares, fixed income securities and other types of assets that can grow throughout our customers' lives. We invest a large proportion of our capital in Sweden, but we also need to invest outside Sweden to spread investment risks and benefit from value growth in other markets. We invested in the three banks concerned together with some of the world's largest asset managers, such as Blackrock, Vanguard and State Street.

In 2022, when Alecta saw that the interest rate increases had an impact on Silicon Valley Bank's liquidity, we, together with other investors, initiated discussions with the bank to ensure that the bank had a plan for the future. On Thursday 9 March, the bank announced a new share issue that was not underwritten by any major investors and a sale of bonds at a loss. We consider that this was a big error and the trigger for what is known as a bank run, where customers withdraw their money quickly, causing share prices to plummet. The collapse of Silicon Valley bank then led to a general fall in confidence in US regional banks, and these concerns spread to the banking sector in many parts of the world.

How much money was lost?

The total loss in the three US banks is estimated at SEK 19.6 billion. This is a substantial loss that we take very seriously, but the impact on our customers will be very small, since Alecta manages total assets of over SEK 1,100 billion. Customers with an ITP2 defined-benefit pension plan will not be affected at all.

Could more money be lost?

We do not currently see any contagion effects, and this was confirmed by the Swedish Financial Supervisory Authority, which shares our view.

People are saying that these were crypto banks?

No, these were not crypto banks. These are three separate banks with completely different business models. Silicon Valley Bank mainly targeted venture capitalists and companies in the technology and life science/healthcare sectors, ranging from start-ups to more mature companies.

Signature Bank's main focus was financing rent-controlled blocks of flats and commercial properties, but it also strived to be at the forefront of technological development through its payment platform where customers could transfer USD in real time. A number of cryptocurrency firms were attracted to the platform and deposited their money there, representing around 15 per cent of the bank's total deposits. The Bank's involvement with digital currencies (crypto) was limited to deposits in US dollars. Signature Bank did not invest in, trade in, or hold digital currencies in its portfolio and did not custody digital currencies. It did not accept digital currencies as loan collateral.

First Republic Bank is approximately 40 years old and focuses primarily on mortgage lending and wealth management to an affluent middle class. Since it was founded, the bank has had extremely low loan losses and high customer satisfaction.

Why did Alecta sell its shares in Handelsbanken and Swedbank to invest in US banks?

Our decision to sell the holdings in the two Swedish banks and to invest in the US banks are two completely different investment decisions.

In 2016, Alecta decided to invest in Signature Bank, and in 2019 the decisions were made to invest in Silicon Valley Bank and First Republic Bank. At that time, we had investments in four major Scandinavian banks: Swedbank, Handelsbanken, Nordea and SEB. We started selling off shares in Swedbank and Handelsbanken in 2021 and 2022, and exited the two banks completely in 2022. Alecta remains a major shareholder in Nordea and SEB.

What steps is Alecta taking to save as much money as possible?

Intensive work is currently under way to ensure that Alecta's customers' rights are safeguarded in the best possible way. We have legal representation on-site in the US to manage the legal process.

Skriv gärna en kommentar om sidan

Vi vill gärna ha förslag och synpunkter som hjälper oss att förbättra vår webbplats. Vi läser allt men svarar inte här. Har du istället ett ärende eller en fråga till vår kundservice kan du skicka ett meddelande eller ringa till oss. Här hittar du våra telefonnummer.

Tack för din synpunkt!

Vi läser alla synpunkter men svarar inte på dem. Om du vill komma i kontakt med oss ber vi dig kontakta vår kundservice